The Tax-free Service

- Because we start the tax-free service at our shop, please confirm the following information when you want to use the service.

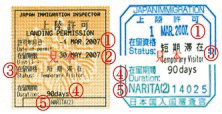

Person eligible for tax exemption Non-residents who made purchases eligible products

(Person who can take the items out of Japan within 30 days of purchase)

Application period Day of purchase only

Eligibility requirement With the total amount of purchase between 5,000 to 500,000yen,excluding tax

Item eligible for tax exemption All items (ex. cosmetics and supplements)

Points to confirm in tax exemption procedure

Your own passport

(necessary immigration stamp/copy unacceptable)Payment method Payment without consumption tax.

- Others

・The item(s) will be packed and sealed in a specified, transparent bag, and also we will pack your item(s) to one bag because the tax free item(s) just for personal use only.

・You are not allowed to open the bag until you have left Japan. If you open the bag and use the item(s), you will be required pay taxes at customs.

・Prior to departure, please show the customs officer the tax free item(s) purchased as well as the "Record of Purchase of Consumption Tax-Exempt for Export Slip" attached to your passport.

When you want to pack the tax free item(s) in your baggage, please ask to the airport staff before check-in.・Please note that if you have purchase to the shop after completing the tax exemption produce, you can't return your item(s).

Please check your item(s) before your payment.